The SEC is adopting an amendment to Security Exchange Act (SEA) Rules 17a-4 and 18a-6 that modernizes record-keeping requirements for broker-dealers, security-based swap dealers (SBSDs) and major security-based swap participants (MSBSPs).

The amendment is technology neutral—not specifying any media—stipulating records be preserved in a manner that permits re-creation of an original record. It also requires security-based swap (SBS) entities to use an electronic record-keeping system in compliance with audit-trail or write once, read many (WORM) requirements.

The final amendments will become effective 60 days after publication in the Federal Register. Broker-dealers will have six months to comply after publication, and SBSDs and MSBSPs will have 12 months to comply.

Background

WORM has been the required method of preserving books and records of all transactions for broker-dealers. Records are currently kept in a non-rewriteable, non-erasable format with explicit notification requirements to use electronic storage media such as flash drives, CDs, or floppy disks. Broker-dealers using electronic storage media were required to engage a third party and provide access and the ability to download information for a designated examination authority (DEA).

Audit-Trail Alternative

The amendment modernizes the SEC’s record-keeping requirement by providing an audit-trail alternative to maintain and preserve records in a manner that permits the re-creation of a modified or deleted original record. The update allows flexibility while maintaining the authenticity and reliability of the original records.

The SEC also directs broker-dealers and SBS entities to verify completeness and accuracy of the records stored by the electronic record-keeping system.Broker-dealers and SBS entities using an electronic record-keeping system must implement a backup system or have other redundancy capabilities such as a backup server or geographic separation in case the originals are temporarily or permanently inaccessible.

Other Modifications

The amendment eliminates the notification requirement for electronic record-keeping systems and the requirement to engage a third party to maintain and preserve records as well as provide certain undertakings to the DEA. Broker-dealers and SBS entities may designate an executive officer to execute the required undertakings, as long as the executive has access to and ability to provide electronically stored data. The amendment will also require broker-dealers and SBS entities to produce electronic records for regulators’ use in a reasonably usable electronic format.

Broker-dealers or SBS entities using a cloud service provider to store records must be able to independently access the data without third-party intervention, and the third party must acknowledge that electronic records are the property of the broker-dealer or the SBS entity.

The third party mustn’t impede or prevent the examination, access, download, or transfer of the records by a representative or designee of the commission as permitted under the law.

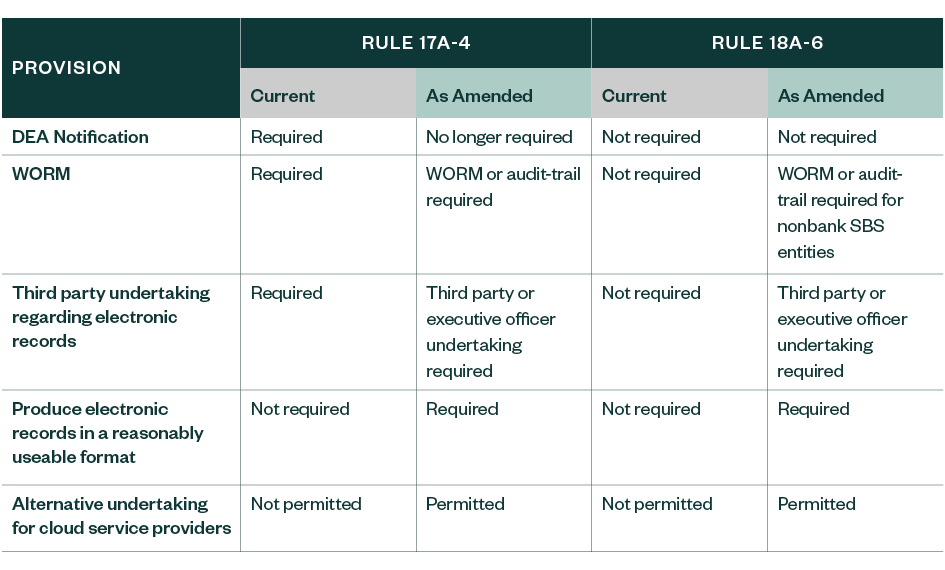

The following table summarizes the amendments.

Electronic Record-keeping Amendments to Rules 17a-4 and 18a-6

We’re Here to Help

To learn more about how SEA Rules 17a-4 and 18a-6 could affect your company, contact your Moss Adams professional.

You can find additional resources at our Asset Management and Broker-Dealers Practices.